主營(yíng)項(xiàng)目/MAIN ITEMS

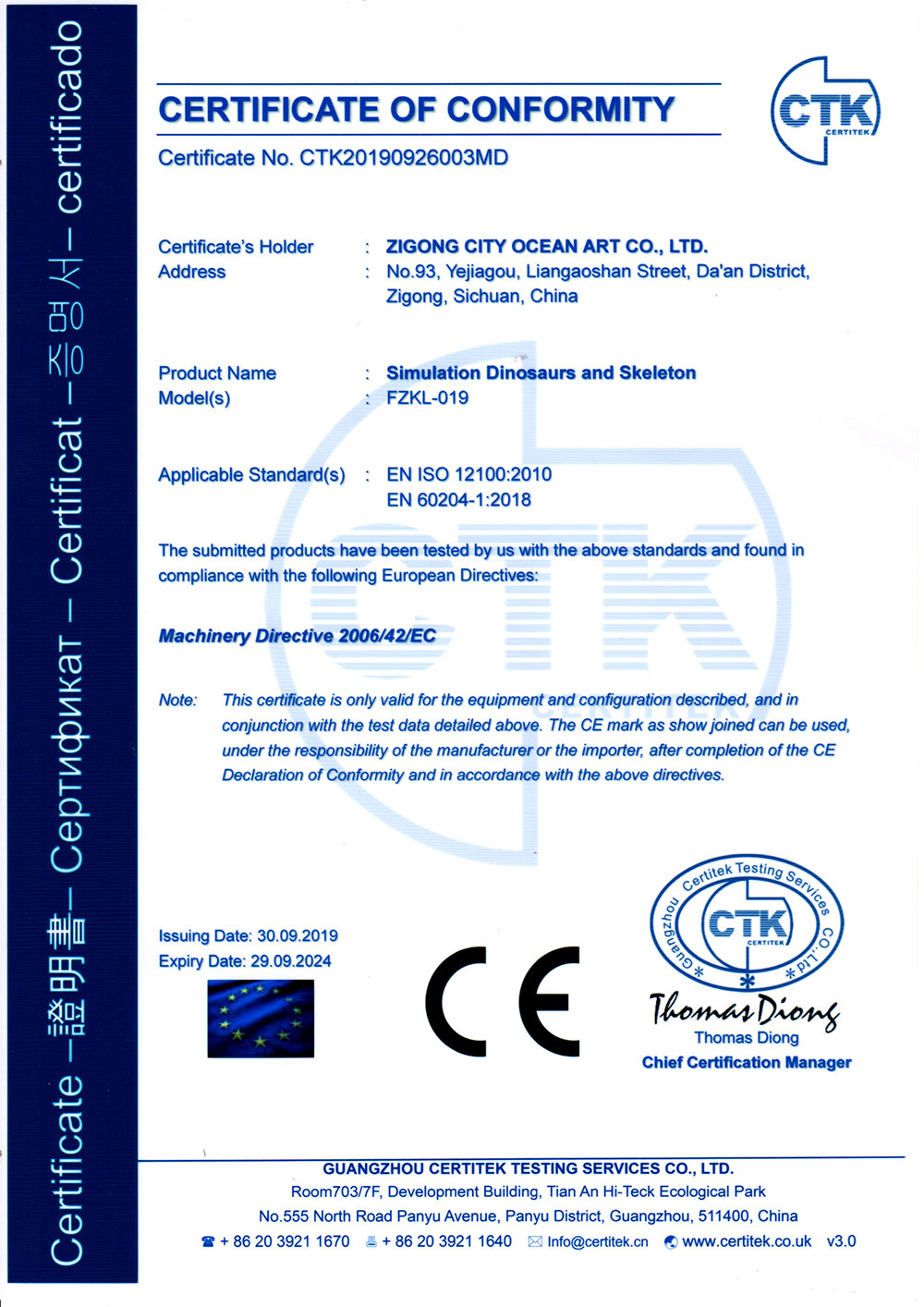

資質(zhì)保障/QUALIFICATION

關(guān)于我們/ABOUT US

+

Company Profile

公司簡(jiǎn)介

自貢市大洋藝術(shù)有限責(zé)任公司簡(jiǎn)介自貢市大洋藝術(shù)有限責(zé)任公司,為中國(guó)恐龍展品制作基地,始建于1996年,是專(zhuān)業(yè)從事恐龍化石骨架標(biāo)本模型、仿真活體機(jī)器恐龍、仿真雕塑恐龍、玻璃鋼恐龍、恐龍游樂(lè)場(chǎng)互動(dòng)設(shè)備等展品的研制開(kāi)發(fā)、出售和展覽的高科技企業(yè)。并在中國(guó)古生物專(zhuān)家的指導(dǎo)下進(jìn)行開(kāi)發(fā)制作恐龍和仿真動(dòng)物展品,所制作的恐龍展品,被中國(guó)科學(xué)院鑒定為“優(yōu)秀科研作品”,被譽(yù)為“侏羅紀(jì)”的再現(xiàn)者。公司占地面積3000平方米,有一支專(zhuān)業(yè)研制恐龍標(biāo)本模型和機(jī)器恐龍展品的職工隊(duì)伍和一套具有先進(jìn)性能的生產(chǎn)設(shè)備,年生產(chǎn)能力為300萬(wàn)美元,其中約70%的出口。我們研制和生產(chǎn)的恐龍展品,以其造型逼真、表皮質(zhì)感強(qiáng)、動(dòng)作協(xié)調(diào)自如、組合情節(jié)科學(xué)、價(jià)格合理、售后服務(wù)佳而倍受?chē)?guó)內(nèi)外客戶(hù)的青睞和好評(píng)。十多年來(lái),我們先后為美國(guó)、加拿大、阿根廷、秘魯、匈牙利、奧地利、荷蘭、澳大利亞和我國(guó)的香港、臺(tái)灣地區(qū)以及北京自然博物館、天津自然博物館、上海自然博物館、重慶自然博物館、浙江自然博物館、成都理工大學(xué)博物館、太原中國(guó)煤炭博物館、內(nèi)蒙二連浩特恐龍博物館、武漢中國(guó)地質(zhì)大學(xué)博物館、西峽恐龍蛋博物館、朝陽(yáng)鳥(niǎo)化石博物館、河源恐龍博物館、常州中華恐龍園、云南祿豐世界恐龍谷等地區(qū)的博物館和恐龍主題公園以及人民公園制作和提供了相當(dāng)數(shù)量的恐龍展品。同時(shí),先后為重慶恐龍公園、海南恐龍公園、晉江新世紀(jì)恐龍公園、番禺古生物博物館、東莞古生物博物館、西峽恐龍蛋博物館設(shè)計(jì)和陳列布展。

合作案例/CASE

大洋優(yōu)勢(shì)/ADVANTAGE

科普知識(shí)/KNOWLEDGE

公司新聞

科普知識(shí)